The Top 3 Stocks to Buy from SoFI’s New AI-Themed ETF

The intelligent automation market is experiencing major growth, with projections now indicating enterprise-focused platforms will surpass $70.91 billion before 2030 as businesses pursue solutions that optimize analytics and real-time processes worldwide. That momentum is confirmed by forecasts showing a compound annual growth rate (CAGR) of 38.9% between 2025 and 2030, surging from $18.22 billion in 2025 to $94.30 billion in 2030, powered by rising adoption of automation, personalization, and predictive analytics in business.

The September 2025 debut of Tidal Trust SoFi’s Agentic AI ETF (AGIQ) was purpose-built to tap into this extraordinary acceleration of artificial intelligence (AI), bringing together companies at the forefront of real-time decision-tech and digital transformation. The new ETF by SoFi (SOFI) has seen a rise of 1.6% since its Sept. 4 launch, settling at $20.25. Three leaders have emerged at the heart of AGIQ’s holdings: Nvidia (NVDA) at 8.47%, Tesla (TSLA) at 8.54%, and Palantir (PLTR) with 7.50%. Each company is pushing boundaries in connected automation and data-powered systems.

Which of these powerhouses will take the lead in shaping tomorrow’s world of intelligent technology? Let’s find out what these three stocks can offer.

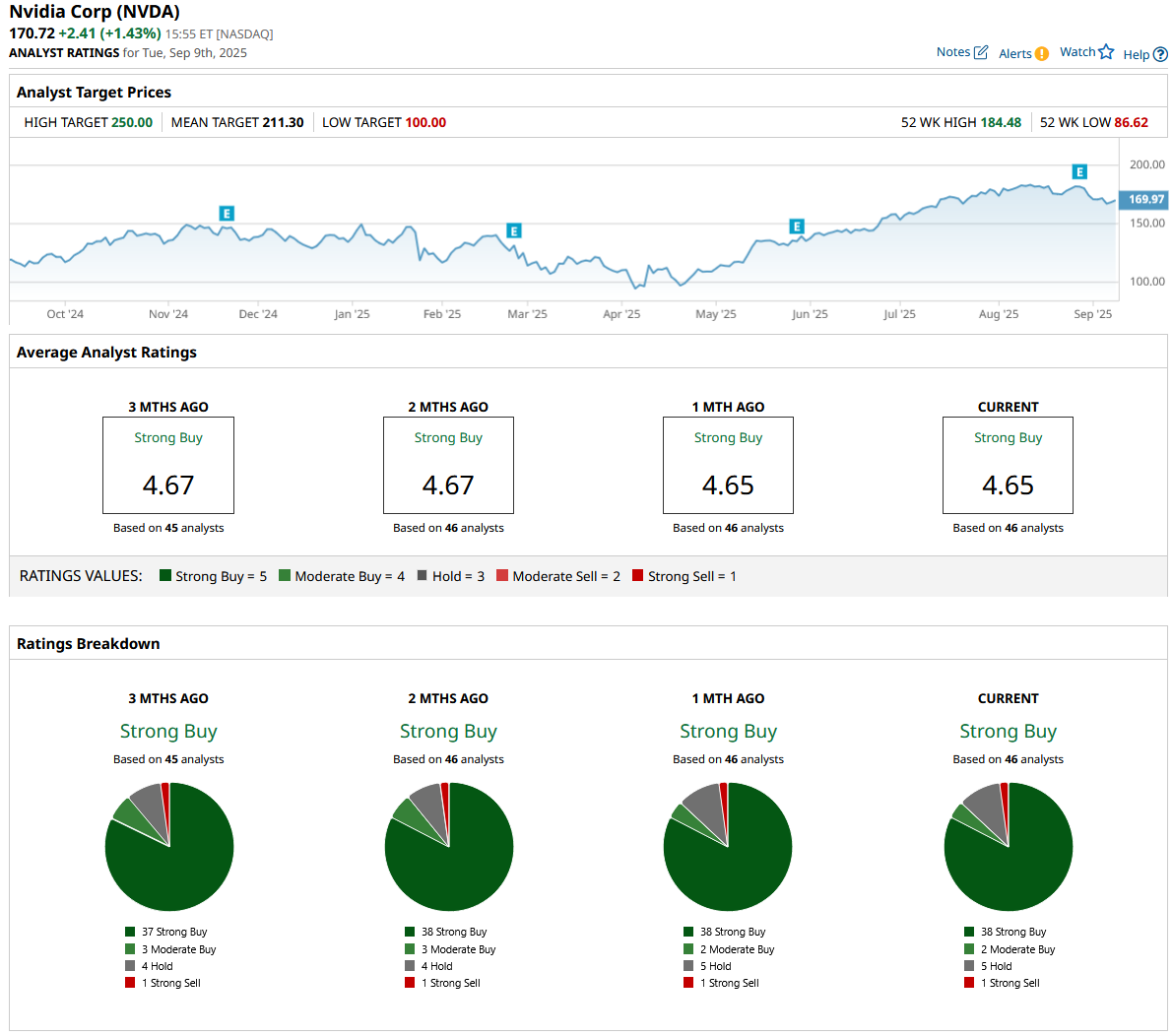

Nvidia (NVDA)

Nvidia designs and manufactures high-performance processors and supercomputing platforms that enable advanced automation and analytics across industries, supporting the AI focus of SoFi’s Agentic AI ETF AGIQ. With a market capitalization of $4.06 billion, it has a modest annual dividend rate of $0.04 and a yield of just 0.02%.

The current price stands at $170.45, with year-to-date (YTD) growth at 26.04% and a 52-week gain of 58.97%.

Its forward price-to-earnings (P/E) ratio stands at 40.90x compared to the sector's median of 23.43x, and its price-to-sales (P/S) ratio is 31.97 versus the sector's median of 3.25x, revealing a substantial premium driven by strong growth expectations.

Expanding internationally, Nvidia has entered a partnership with HUMAIN, the Saudi Public Investment Fund's (PIF) AI subsidiary, to build a hyperscale AI data center in Saudi Arabia with capacity targets reaching 500 megawatts powered by 18,000 Grace Blackwell GPUs. In related efforts, Nvidia is deploying 800-volt HVDC architecture, partnering with Navitas Semiconductor (NVTS) and Vertiv (VRT) to modernize data center power systems, pushing technological boundaries in infrastructure advancement.

On Aug. 27, 2025, Nvidia posted revenue of $46.7 billion, rising 6% quarter-over-quarter (QoQ) and 56% year-over-year (YoY). Data center revenue came in at $41.1 billion, while Blackwell Data Center figures grew 17% sequentially. Gross margins hit 72.4% GAAP, with earnings per share at $1.08 GAAP and $1.05 non-GAAP. The company returned $24.3 billion to shareholders in the first half of fiscal 2026 and authorized an additional $60 billion in buybacks.

Nvidia’s earnings outlook remains strong, with analysts expecting $1.16 per share for Q4 2025 and $4.20 for fiscal 2026, with growth estimates of 48.72% and 43.34% YoY. The next earnings release is anticipated in October 2025. The analyst consensus is firmly positive, as all 46 surveyed offer a “Strong Buy” rating and a mean price target of $211.53, implying a 26.7% upside.

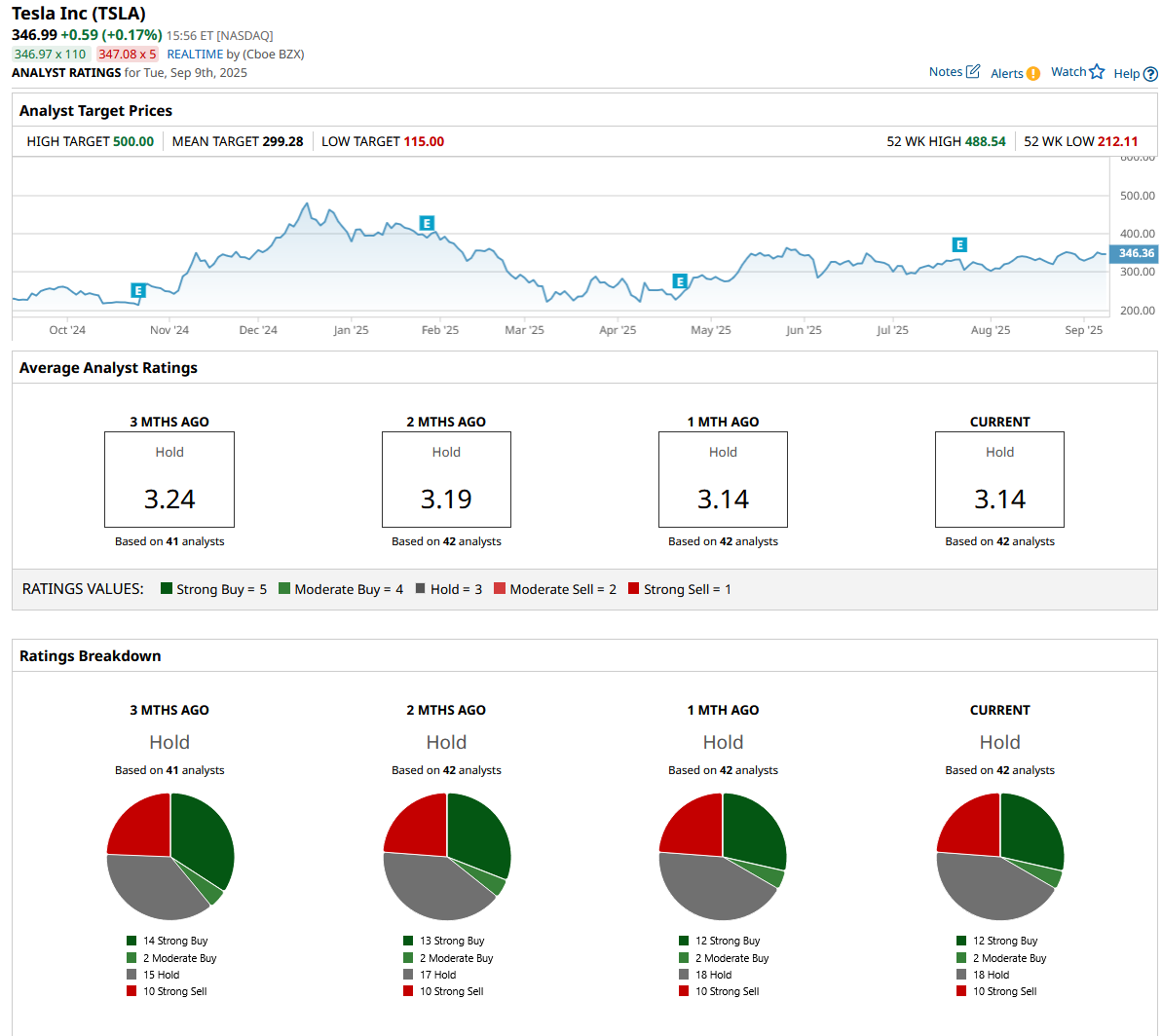

Tesla (TSLA)

Tesla specializes in electric vehicles (EVs), clean energy solutions, and intelligent automation for transportation and home energy. The company’s market capitalization is $1.13 trillion, affirming its sector dominance. With share performance showing a decline of 14.17% YTD but a rise of 60.27% over the last year. TSLA stock currently trades at $346.93.

Its valuation presents a distinctive profile, as the trailing twelve-month P/E ratio sits at 199.14x, with the sector median at just 17x, and the forward ratio at 282.70x compared to a sector median of 18.31x, highlighting investor anticipation for Tesla’s technological advances despite demanding multiples.

A recent $16.5 billion partnership with Samsung Electronics (SMSN.L.EB) ensures vertical integration of custom AI6 chips for full self-driving (FSD) vehicles, robotics, and high-performance data centers, fortifying supply chain oversight and enabling product innovation at scale. Meanwhile, the joint energy initiative with Sunrun (RUN) gives Texas homeowners advanced battery systems with Flex solar technology, competitive sellback rates for excess power, and state-of-the-art outage protection, driving durable growth for both Tesla Electric and its residential energy markets.

Tesla’s July 23, 2025, earnings release revealed Q2 vehicle deliveries of 384,122, falling short of expectations by 3.4%. Revenue was reported at $22.5 billion, narrowly missing analysts' estimates by 1.1%, while operating profit reached $923 million against a projected $1.21 billion. EPS matched expectations at $0.40, gross margin was steady at 17.2%, and operating margin slipped to 4.1% from 6.3% last year, as CEO Musk emphasized the importance of capacity expansion and new platform launches.

Earnings estimates point to $0.36 for Q3 2025, $1.20 for fiscal year 2025, and $2.00 for 2026, with anticipated YoY declines of around 41% before rebounding to 66.67% growth in 2026; the next earnings release is set for Oct. 22, 2025. Analyst views are neutral, as reflected in a consensus “Hold” rating from all 42 polled, and the mean target price of $299.28 implies a 13.7% downside from current levels.

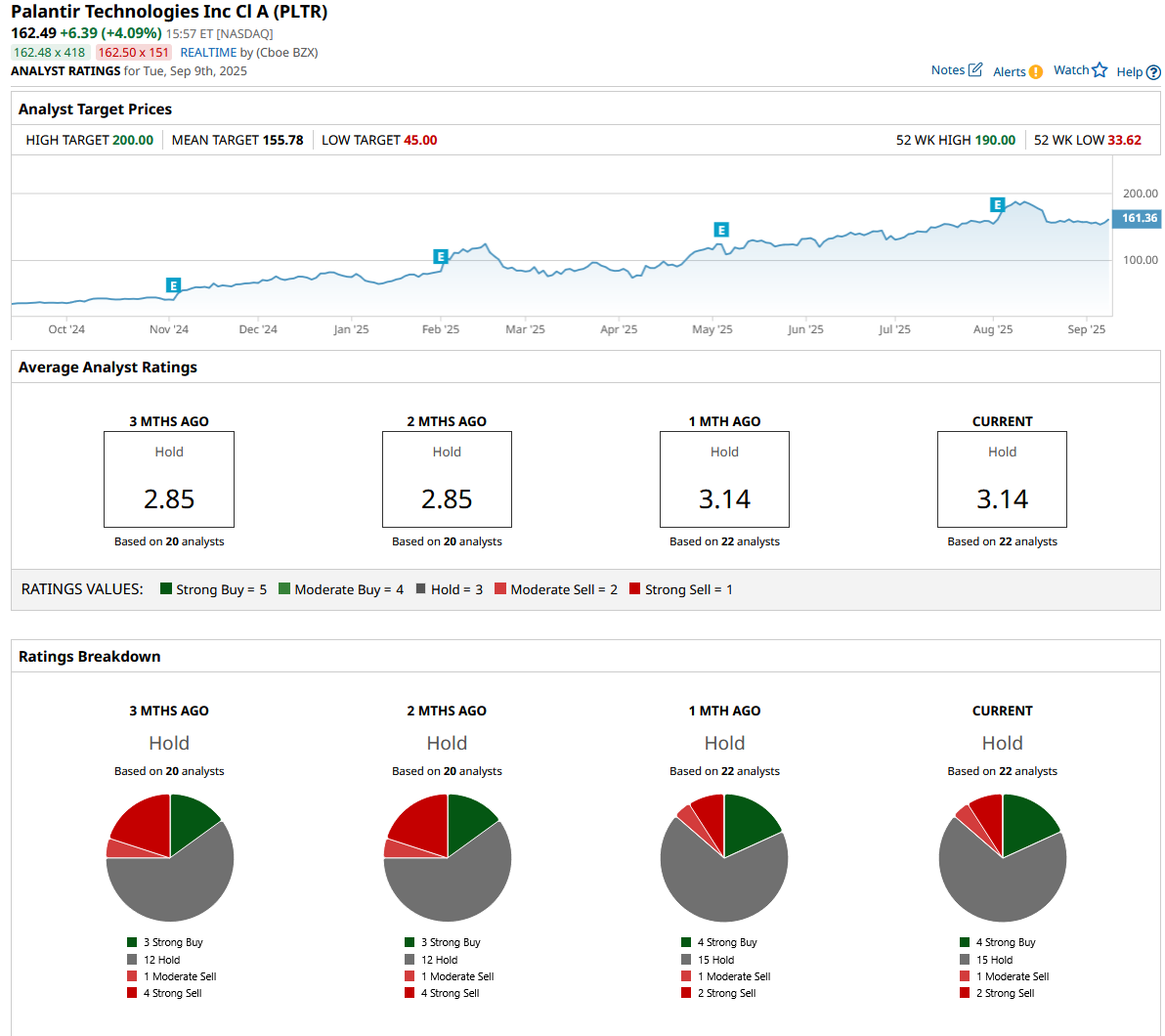

Palantir (PLTR)

Palantir builds enterprise software for data integration, analytics, and machine intelligence across commercial and government missions. Palantir has climbed 113% YTD and 366% over the past year. PLTR stock is now priced at $162.48.

It has a forward P/E ratio of 358.94x versus the sector median of 23.43x, a P/S ratio of 129.27x compared to the sector median of 3.36x, and a market capitalization of $363.23 billion.

PLTR is reinforced by its new partnerships. Palantir is accelerating telecom transformation by integrating its Foundry and AIP platforms across Lumen Technologies’ operations, streamlining workflows, and driving modernization in network infrastructure. The company’s expanded five-year alliance with Lear harnesses the IDEA analytics platform, which has already delivered more than $30 million in savings for Lear through the first half of 2025, raising efficiency and deepening Palantir’s impact within the automotive sector.

On Aug. 4, 2025, Palantir reported Q2 revenue of $1.004 billion, up 48% year over year and 14% sequentially, as U.S. revenue rose 68% to $733 million, U.S. commercial revenue advanced 93% to $306 million, and U.S. government revenue increased 53% to $426 million. The quarter included 157 deals of at least $1 million, adjusted operating income of $464 million at a 46% margin, GAAP net income of $327 million at a 33% margin, adjusted EPS of $0.16, and adjusted free cash flow of $569 million at a 57% margin.

The forward outlook signals EPS of $0.11 for the September 2025 quarter and $0.44 for fiscal year 2025, reflecting anticipated YoY growth rates of 83.33% and 450%. This consensus is rated “Hold” by 22 analysts, and the mean target of $155.78 stands just 5% below its current price of $162.49.

Conclusion

NVDA, TSLA, and PLTR are the three to own from SoFi’s AGIQ because they sit at the center of AI infrastructure autonomy and enterprise adoption with meaningful catalysts and durable roadmaps fueling the theme. In the near term, shares will most likely trend higher as execution and partnerships sustain demand across chips, mobility, and data platforms, though pullbacks can appear on hot prints or extended valuations. Over the next few quarters, a gradual grind up is the base case if earnings and deal flow keep confirming strength.

On the date of publication, Ebube Jones did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.