Is Walmart Stock Outperforming the Dow?

With a market cap of around $767 billion, Walmart Inc. (WMT) is a global retailer that operates through three main segments: Walmart U.S., Walmart International, and Sam’s Club. The company runs retail and wholesale stores, eCommerce platforms, and digital payment services, offering a broad assortment of merchandise, groceries, health and wellness products, and financial solutions.

Companies valued at more than $200 billion are generally considered “mega-cap” stocks, and Walmart fits this criterion perfectly. Guided by its everyday low price (EDLP) philosophy and omni-channel strategy, Walmart helps customers save money and live better by seamlessly integrating in-store and online shopping experiences.

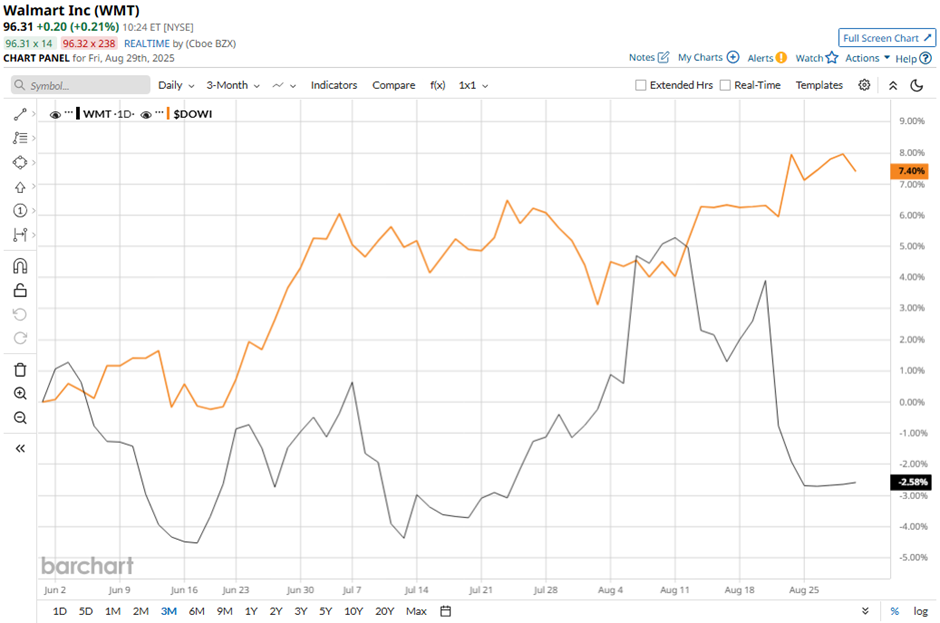

Shares of the Bentonville, Arkansas-based company have decreased 9% from its 52-week high of $105.30. Over the past three months, its shares have declined 1.3%, underperforming the broader Dow Jones Industrials Average's ($DOWI) 7.8% gain during the same period.

Longer term, WMT stock is up 6.1% on a YTD basis, slightly lagging behind DOWI's 7% rise. However, shares of the company have returned nearly 26% over the past 52 weeks, outperforming DOWI’s 10.8% increase over the same time frame.

The stock has been in a bullish trend, consistently trading above its 200-day moving averages since last year.

Walmart shares fell 4.5% on Aug. 21 after its Q2 2026 adjusted EPS came in at $0.68, missing the consensus estimate despite revenue rising 4.8% year-over-year to $177.4 billion, above the estimate. Operating income declined 8.2% to $7.3 billion, pressured by discrete legal and restructuring costs, higher liability claims, wage increases, and strategic investments that offset strong e-commerce and membership income growth.

Additionally, WMT stock has performed better than its rival, Costco Wholesale Corporation (COST). COST stock has returned 3.3% YTD and 6.6% over the past 52 weeks.

Due to WMT's outperformance over the past year, analysts remain bullish about its prospects. The stock has a consensus rating of “Strong Buy” from 37 analysts in coverage, and the mean price target of $112.97 is a premium of 17.3% to current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.