Are Wall Street Analysts Predicting Autodesk Stock Will Climb or Sink?

/Autodesk%20Inc_%20Portland%20office-by%20hapabapa%20via%20iStock.jpg)

With a market cap of $61.8 billion, Autodesk, Inc. (ADSK) is a global leader in 3D design, engineering, and entertainment software, serving industries such as architecture, engineering, construction, manufacturing, and media. The company provides innovative solutions like AutoCAD, Revit, Fusion, and Maya, enabling customers to design, build, and create with efficiency and precision.

Shares of the San Francisco, California-based company have slightly outpaced the broader market over the past 52 weeks. ADSK stock has increased 15.4% over this time frame, while the broader S&P 500 Index ($SPX) has risen 14.3%. However, shares of the company are down 2.4% on a YTD basis, lagging behind SPX's 8.7% gain.

In addition, shares of the design software company have also marginally outperformed the Technology Select Sector SPDR Fund's (XLK) 14.9% return over the past 52 weeks.

Shares of Autodesk rose marginally on May 22 after the company reported Q1 2026 revenue of $1.6 billion and adjusted EPS of $2.29, above analyst expectations. The company also raised its fiscal 2026 revenue outlook to $6.93 billion - $7 billion and boosted adjusted EPS guidance to $9.50 - $9.73. Investor sentiment was further supported by strong adoption of its cloud-based design tools and ongoing investments in AI.

For the fiscal year ending in January 2026, analysts expect ADSK's EPS to grow 12.6% year-over-year to $6.60. The company's earnings surprise history is mixed. It beat the consensus estimates in three of the last four quarters while missing on another occasion.

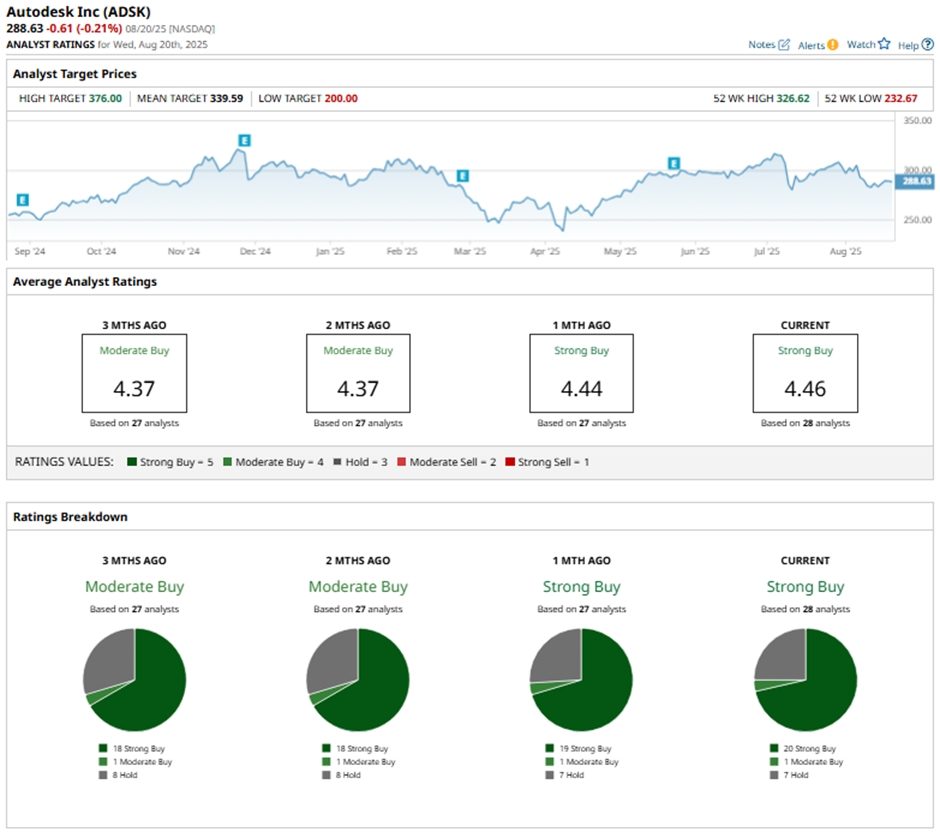

Among the 28 analysts covering the stock, the consensus rating is a “Strong Buy.” That’s based on 20 “Strong Buy” ratings, one “Moderate Buy,” and seven “Holds.”

This configuration is more bullish than three months ago, with 18 “Strong Buy” ratings on the stock.

On Aug. 20, Barclays analyst Saket Kalia reiterated a “Buy” rating on Autodesk and set a price target of $355.

The mean price target of $339.59 represents a 17.7% premium to ADSK’s current price levels. The Street-high price target of $376 suggests a 30.3% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.