Michael Burry Is Betting Big on Lululemon Stock. Should You?

/Lululemon%20Athletica%20inc_%20storefront%20by-%20Robert%20Way%20via%20iStock.jpg)

Lululemon Athletica (LULU) hasn’t exactly been the smooth ride investors once enjoyed. The Canadian athletic apparel maker rode the pandemic athleisure boom to record sales, but that momentum has cooled. Today, the story looks very different. Revenue growth has slowed significantly, competition in the premium sportswear category is intensifying, and U.S. consumers are tightening their budgets on discretionary items. Adding to the strain, tariffs introduced by President Donald Trump are weighing on costs, forcing the company to trim its full-year profit outlook.

Amid the turbulence, one surprising buyer has stepped in. Michael Burry, the legendary investor who famously predicted the 2008 housing crash — a move that inspired Hollywood’s “The Big Short” — has decided this beaten-down stock deserves a place in his portfolio. According to Scion Asset Management’s second-quarter 2025 13F filing, Burry scooped up 50,000 shares worth nearly $11.9 million, giving the stock a 2.1% weighting in his portfolio.

For someone with a reputation for spotting opportunities where others see trouble, this is undoubtedly a notable vote of confidence. And the move has investors talking. Lululemon may be battling softer demand and tariff headwinds, but does Burry’s stake make LULU stock a buy now?

About Lululemon Stock

Valued at about $23.7 billion by market capitalization, Lululemon designs and sells athletic apparel, footwear, and accessories for activities like yoga, running, training, tennis, and golf. The company operates 770 stores across over 20 markets, working closely with local athletes to gather feedback that helps refine fabrics and functional designs.

This hands-on approach keeps Lululemon at the forefront of innovation in sportswear, blending performance and style for a wide range of activities. However, the apparel landscape is constantly shifting, and LULU shares are feeling the impact. Consumers are turning to rival brands and dialing back spending on athleisure compared with the pandemic peak, hitting the company’s sales momentum.

LULU stock has tumbled sharply, down nearly 54% from its 52-week high of $423.32 set this January and down 48% in 2025. By contrast, the broader S&P 500 Index ($SPX) has managed a modest 8.4% gain over the same period, highlighting just how starkly Lululemon has lagged behind the market. Yet, Michael Burry’s recent stake in the company seems to have lifted investor sentiment, with LULU climbing almost 1% over the past five days.

The steep selloff has made Lululemon stock look increasingly appetizing from a valuation perspective. At just 14 times forward earnings, the stock sits well below the sector median and far under its own five-year average. That significant gap in valuation makes LULU appear far cheaper than both its peers and historical norms, putting it back on the radar for value-focused investors.

Lululemon Slides After Q1 Earnings Report

Lululemon dropped its fiscal 2025 Q1 earnings report on June 5, and the market wasn’t impressed. LULU stock plunged nearly 20% the next trading session as investors focused less on the earnings beat and more on the cracks beneath the surface. Revenue came in at $2.37 billion, up 7% year-over-year (YOY) and just a hair above Wall Street’s $2.36 billion estimate. EPS landed at $2.60, up 2.4% YOY and narrowly ahead of the $2.59 forecast.

At first glance, that might seem like a win, but a closer look tells a different story. Comparable sales growth came in at a soft 1% globally, weighed down by a 2% drop in the Americas, a region that remains Lululemon’s core market. Bright spots did appear overseas, where international sales surged 19%, underscoring the company’s global expansion strategy.

On the margin front, gross margin improved 60 basis points annually to 58.3%, but operating margin slipped to 18.5% from 19.6% a year ago. Higher tariffs, climbing costs, and swelling inventory levels were the main culprits. And that inventory figure was a real red flag. Stockpiles ballooned 23% YOY to $1.7 billion by the end of Q1, sparking concerns that markdowns may be looming in the coming quarters.

Lululemon still boasted $1.3 billion in cash and cash equivalents at quarter’s end and tapped into shareholder returns, repurchasing shares worth $430.4 million. It also added three net new company-operated stores, bringing the total to 770 worldwide. Yet, despite these positives, the negatives were too loud to ignore. The inventory build, shrinking operating margin, and weak domestic sales overshadowed the international momentum.

Investors were further rattled when Lululemon cut its full-year EPS guidance to a range between $14.58 and $14.78, down from the earlier forecast of $14.95 to $15.15. Revenue guidance for fiscal 2025 was unchanged at $11.15 billion to $11.3 billion, but management cited a “dynamic macroenvironment” as the reason for the more cautious outlook.

What Do Analysts Think About Lululemon Stock?

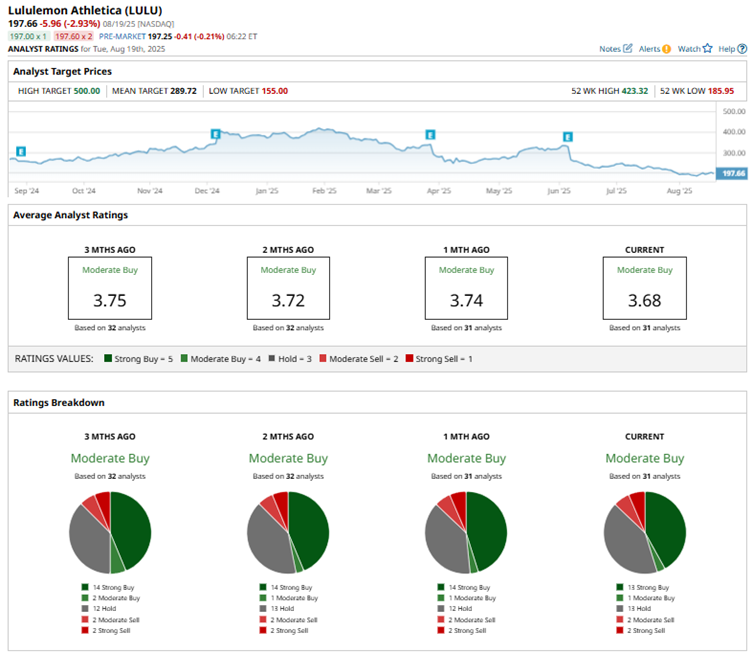

While LULU stock is struggling, Wall Street hasn’t lost faith, maintaining a consensus “Moderate Buy” rating overall. Of the 31 analysts offering recommendations, 13 advocate a “Strong Buy,” one leans toward a “Moderate Buy,” 13 urge investors to “Hold,” two analysts call for a “Moderate Sell,” and two more stick with a “Strong Sell.”

The average analyst price target of $289.72 represents potential upside of 47%. Meanwhile, the Street-high target of $500 suggests a 155% rally from current levels.

Final Thoughts

Lululemon stock may be under pressure, but Michael Burry’s entry is a strong vote of confidence that the story isn’t all bearish. The athleisure giant continues to expand its international footprint, and steady buybacks underscore management’s confidence in long-term value creation. With shares trading at a steep discount to both peers and historical norms, the bar for a turnaround is far lower than in the past. That said, for patient investors, Lululemon could be a compelling bet.

On the date of publication, Anushka Mukherji did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.