Use This Options Strategy to Profit When Stocks Go Nowhere

When most traders think of making money in the markets, they picture buying low and selling high — or riding a trend. But what’s the best trade to make when a stock does absolutely nothing? That’s where the short straddle comes in.

What is a Short Straddle?

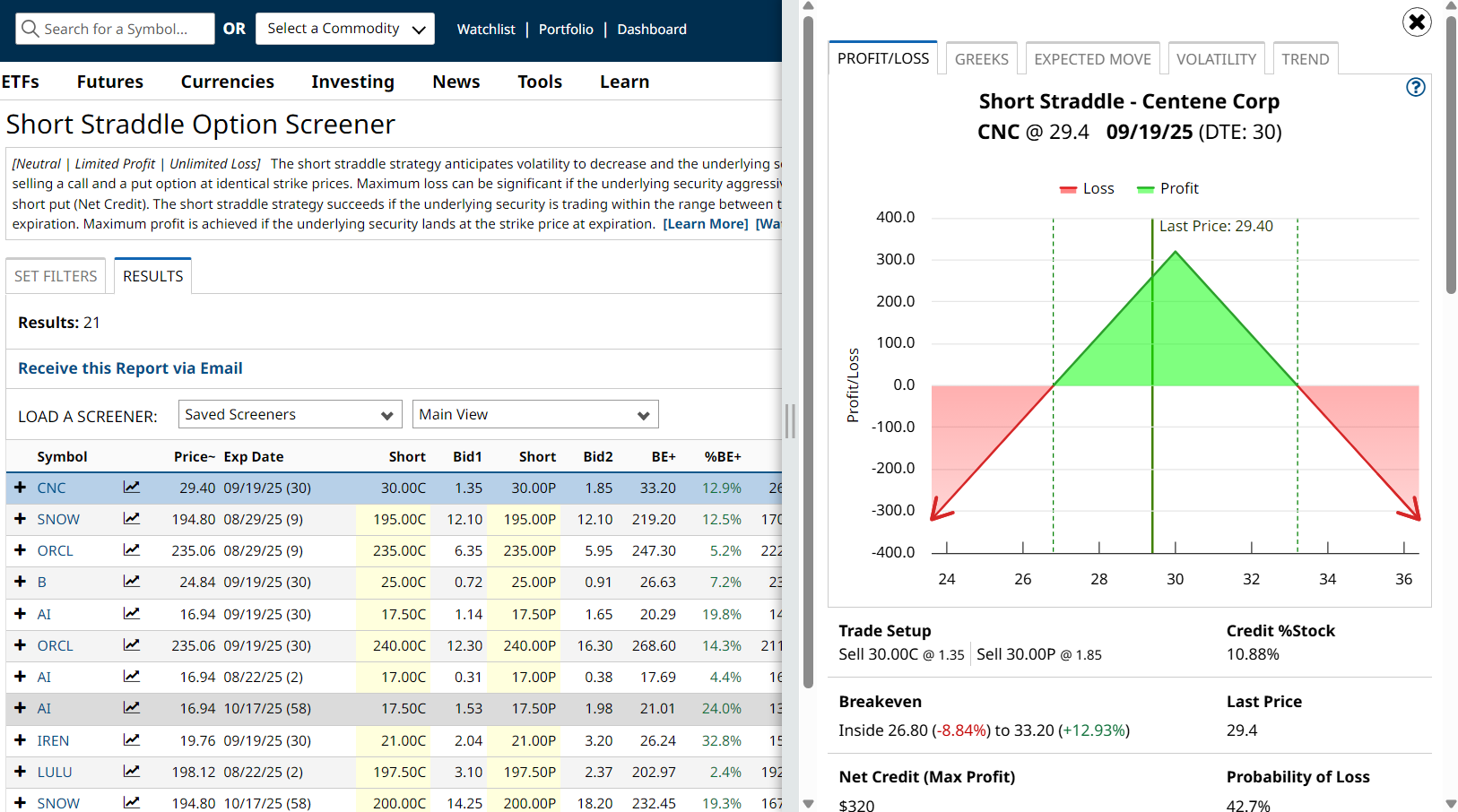

A short straddle is an options strategy where you sell both a call and a put at the same strike price, typically at-the-money. This trade works best in neutral markets — when you expect the stock to stay flat.

Because you’re selling options, you immediately collect a premium. If the stock remains within your breakeven range until expiration, you keep that premium as profit. The trade generates income from time decay (theta) as each day passes.

But here’s the catch:

- Unlimited risk on the upside (if the stock rallies hard).

- Significant downside risk if the stock sells off.

- Low chance of perfection—the stock almost never closes exactly at your strike price.

That’s why tools and risk management matter.

Why Traders Use Short Straddles

- High Premiums: You collect more upfront compared to selling single options.

- Income in Flat Markets: Perfect for times when volatility contracts or price action stalls.

- Defined Breakeven Zone: You know exactly where you make or lose money.

Professional traders use short straddles when volatility is high, but they believe the actual stock move will be smaller than expected.

Finding the Best Short Straddles with Barchart

This is where Barchart tools give traders an edge:

- Options Screener: Quickly sort through tickers with high implied volatility and strong premiums.

- Greeks Tab: Evaluate theta (time decay) and delta (directional risk) before entering.

- Expected Move Tool: Compare implied move to historical volatility — because if the options market is pricing in a bigger move than you expect, short straddles can shine.

- P&L Charts: Rick Orford highlights Barchart’s new P&L Charting Tool, which gives a visual map of profit zones, breakevens, and risk levels so you know exactly what you’re stepping into.

Risk Management is Key

Short straddles are powerful, but can be dangerous. Always have a plan:

- Close or adjust the trade if losses hit a predefined level.

- Use conservative position sizing, and never risk too much on a single straddle.

- Watch volatility: if it starts to expand, so does your risk.

Watch Rick Orford’s Full Breakdown

Rick Orford’s latest video walks through:

- A live short straddle trade breakdown

- How to use Barchart’s tools step-by-step

- Breakeven and profit/loss analysis

- Practical risk management tips

Whether you’re just paper trading or ready to go live, mastering short straddles can add a powerful income strategy to your playbook.

Watch this quick breakdown on how to use the short straddle PnL charts, then check out the full guide when you’re ready to learn more:

On the date of publication, Barchart Insights did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.