What Are Wall Street Analysts' Target Price for Brown-Forman Stock?

Valued at a market cap of $14.4 billion, Brown-Forman Corporation (BF-B) is a family-controlled leader in the global spirits and wine industry. The Kentucky-based company’s portfolio features iconic brands such as Jack Daniel’s, Woodford Reserve, Old Forester, and several Scotch, tequila, and liqueur labels.

BF-B’s shares have significantly lagged behind the broader market over the past 52 weeks. Brown-Forman has declined 31.7% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 14.3%. Moreover, the stock is down 19.9% on a YTD basis, compared to SPX’s 8.7% rise during the same time frame.

Zooming in further, BF-B’s underperformance looks even more pronounced when compared to the Consumer Staples Select Sector SPDR Fund’s (XLP) 2.5% return over the past 52 weeks and 5.9% gain on a YTD basis.

Shares of Brown-Forman dropped 17.9% on June 5, after the company reported disappointing Q4 results. Revenue came in at $894 million, missing analyst expectations, while adjusted EPS of $0.31 fell 13.9% below consensus estimates, signaling weaker-than-anticipated performance.

For the current fiscal year, ending in April 2026, analysts expect BF-B’s EPS to decline 9.8% year over year to $1.66. The company’s earnings surprise history is mixed. It topped the Wall Street estimates in two of the last four quarters while missing on the other two occasions.

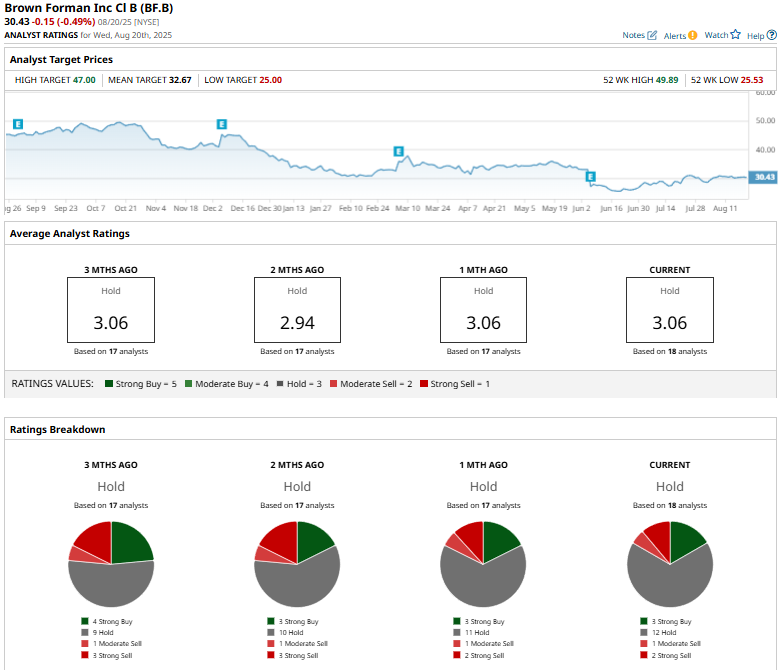

Among the 18 analysts covering the stock, the consensus rating is a “Hold,” which is based on three “Strong Buy,” 12 “Hold,” one “Moderate Sell,” and two “Strong Sell” ratings.

This configuration is more bearish than three months ago, when four analysts rated the stock a “Strong Buy.”

On Jul. 9, Redburn-Atlantic upgraded Brown-Forman from “Sell” to “Neutral,” while cutting its price target from $40 to $30. The firm cited the company’s stalled U.S. market, which has fueled a two-year downward trend and stock de-rating. While international expansion remains a compelling growth avenue, it carries lower margins and tariff risks.

The mean price target of $32.67 represents a 7.4% upside from Brown-Forman’s current price levels. The Street-high target of $47 implies that the stock could soar by 54.5% from the prevailing levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.