Is Wall Street Bullish or Bearish on TE Connectivity Stock?

/TE%20Connectivity%20Ltd%20HQ%20photo-by%20Michael%20Vi%20via%20Shutterstock.jpg)

With a market cap of $59.6 billion, TE Connectivity plc (TEL) is a global leader in designing and manufacturing connectivity and sensor solutions that enable the flow of power and data across diverse industries. It serves markets ranging from automotive and aerospace to energy, healthcare, and communications through its Transportation, Industrial, and Communication Solutions segments.

Shares of the Ballybrit, Ireland-based company have outpaced the broader market over the past 52 weeks. TEL stock has increased 34.3% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 14.3%. Moreover, the stock is up nearly 41% on a YTD basis, compared to SPX's 8.7% gain.

In addition, shares of the electronics maker have outperformed the Technology Select Sector SPDR Fund's (XLK) 15.9% return over the past 52 weeks.

Shares of TE Connectivity surged nearly 12% on Jul. 23 after the company posted better-than-expected Q3 2025 results, with adjusted EPS of $2.27 and revenue of $4.5 billion. Investor sentiment was further boosted by a 30% year-over-year sales surge in the Industrial Solutions segment, driven by strong demand from AI applications and modern data centers. Additionally, management issued an upbeat Q4 outlook, guiding revenue of $4.6 billion and adjusted EPS of $2.27, both above Street expectations.

For the fiscal year ending in September 2025, analysts expect TEL's adjusted EPS to grow 13.8% year-over-year to $8.60. The company's earnings surprise history is promising. It beat or met the consensus estimates in the last four quarters.

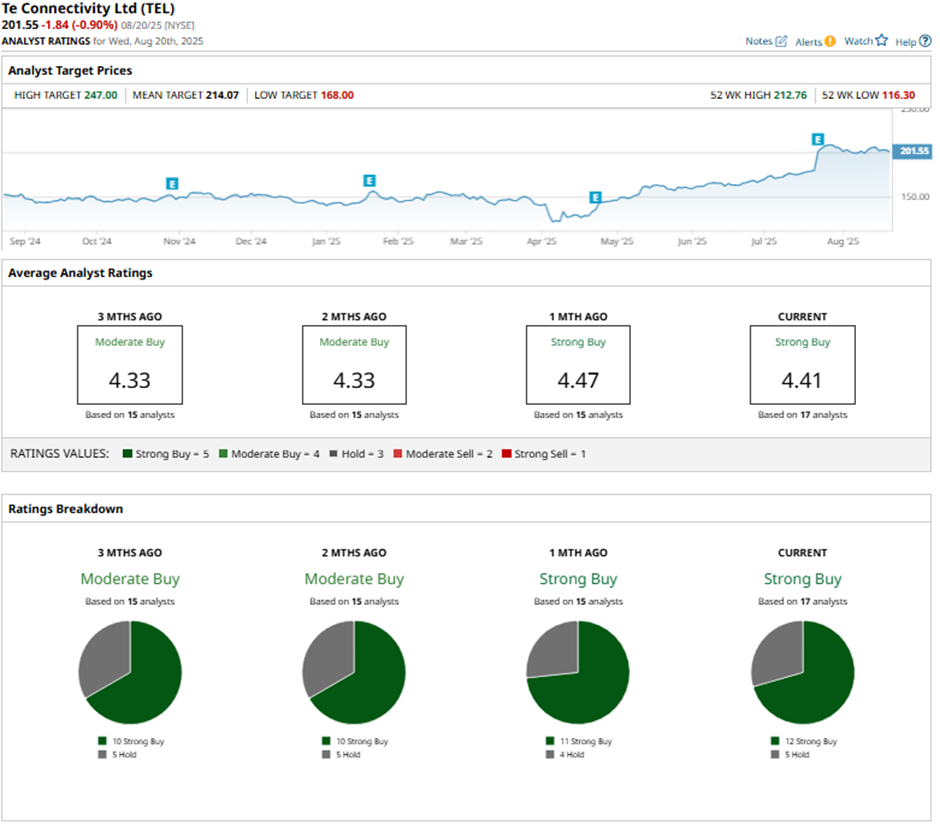

Among the 17 analysts covering the stock, the consensus rating is a “Strong Buy.” That’s based on 12 “Strong Buy” ratings and five “Holds.”

This configuration is more bullish than three months ago, with 10 “Strong Buy” ratings on the stock.

On Aug. 12, Evercore ISI analyst Amit Daryanani reiterated an "Outperform" rating on TE Connectivity and raised the firm’s price target to $225.

The mean price target of $214.07 represents a 6.2% premium to TEL’s current price levels. The Street-high price target of $247 suggests a 22.6% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.