Hartford Insurance Stock: Is Wall Street Bullish or Bearish?

/Hartford%20Financial%20Services%20Group%20Inc_%20magnified%20logo-by%20Casimiro%20PT%20via%20Shutterstock.jpg)

Connecticut-based The Hartford Insurance Group, Inc. (HIG) is a prominent Fortune 500 insurance and investment company. With a market cap of $37.7 billion, it provides insurance and financial services to individual and business customers.

Shares of this insurance company have outpaced the broader market over the past 52 weeks. HIG has rallied 20.8% over this time frame, while the broader S&P 500 Index ($SPX) has gained 14.3%. Moreover, on a YTD basis, the stock is up 22.5%, compared to SPX’s 8.7% rise.

Zooming in further, HIG has also outperformed the Invesco KBW Property & Casualty Insurance ETF’s (KBWP) 11.3% uptick over the past 52 weeks and 5.5% return on a YTD basis.

On July 28, Hartford reported a strong Q2 performance, with core earnings soaring 31% to $981 million ($3.41 per share), driven by robust premium growth in P&C, disciplined underwriting, and higher investment income. The company also returned $549 million to shareholders through buybacks and dividends, underscoring its financial strength and commitment to shareholder value. HIG shares rose 2.8% in the following trading session.

For the current fiscal year, ending in December, analysts expect HIG’s EPS to grow 12.5% year over year to $11.59. The company’s earnings surprise history is promising. It exceeded the consensus estimates in each of the last four quarters.

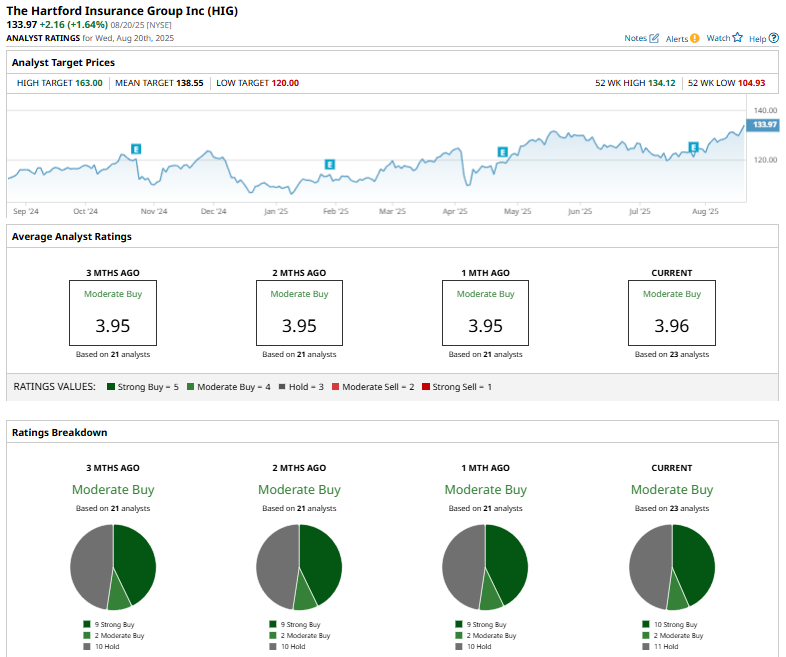

Among the 23 analysts covering the stock, the consensus rating is a “Moderate Buy,” which is based on ten “Strong Buy,” two “Moderate Buy,” and 11 “Hold” ratings.

The configuration is bullish than it was a month ago, when nine analysts had suggested a “Strong Buy” rating for the stock.

On Aug. 4, Keefe, Bruyette & Woods analyst Meyer Shields reiterated an "Outperform" rating on Hartford Insurance Group and raised the price target from $135 to $137, representing a 1.48% upward revision.

The mean price target of $138.55 represents a 3.4% premium from HIG’s current price levels, while the Street-high price target of $163 suggests an upside potential of 21.7%.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.