Grain Markets Firm After a Softer Sunday Night Trade

Wheat

Friday’s Recap

Friday’s Wheat market was mostly lower with the March contract losing 5’0 to 582’6. Combined volume came in at a one month high of 226,885, with March seeing a heavy 106,334 traded. Across all maturities, open interest decreased by 15,011 (3.15%), with March lower by 20,269, or 10.38%, to 175,019.

Technicals

Today officially marks the 1-month anniversary of the contract low. Since then, the market has been working hard to carve out a trend of higher lows and higher highs. Last week’s price action continued to aid the Bullish setup on the chart, but the Bulls still have their work cut out for them. Consecutive closes back above 4-star resistance from 596 3/4-599 1/2 could be the catalyst to spark a bigger short covering rally.

Technical Levels of Importance

Resistance: 588 3/4**, 596 3/4-599 1/2****

Pivot: 574 1/2-577 1/2

Support: 564 3/4-569***, 548 1/2-554 3/4***

Popular Options

Option trading centered around the May 620 calls with 2,549 done and the March 560 puts with volume of 1,106. Calls with the greatest open interest are the May 620 strike (12,800), and for the puts are the March 520 strike (7,452).

Volatility Update

As measured by WVL, implied volatility was down, dropping 0.66 to close at a one week low of 31.24. Adding 0.0886% to a one month high, historical volatility (as measured by the 30-day) ended at 26.33%. The WVL Skew closed moderately lower, dropping by 0.2 to settle at 5.53.

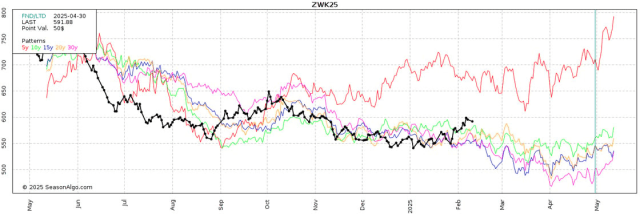

Seasonal Tendencies Update

(Updated on 2.10.25)

Below is a look at historical price averages for May wheat futures on a 5, 10, 15, 20, and 30 year time frames (Past performance is not necessarily indicative of future results).

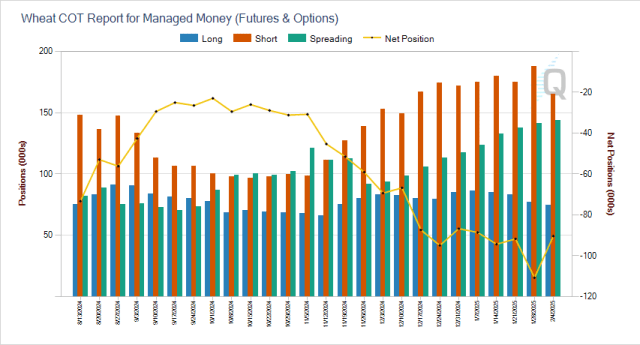

Commitment of Traders Update

(Updated on 2.10.25)

- Friday’s Commitment of Traders report showed Funds were net buyers of roughly 20k futures/options contracts through 2/4/25, majority of which was short covering. That shrunk their net long position to 90,442. Broken down, that’s about 165k shorts VS 74k longs.

Stay ahead of the herd!

Subscribe to our daily Livestock Roundup for exclusive insights into Feeder Cattle, Live Cattle, and Lean Hogs. Get access to our proprietary trading levels and actionable market biases delivered straight to your inbox—every day.

Sign Up for Free Futures Market Research – Blue Line Futures

Futures trading involves substantial risk of loss and may not be suitable for all investors. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Trading advice is based on information taken from trade and statistical services and other sources Blue Line Futures, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results.

Blue Line Futures is a member of NFA and is subject to NFA’s regulatory oversight and examinations. However, you should be aware that the NFA does not have regulatory oversight authority over underlying or spot virtual currency products or transactions or virtual currency exchanges, custodians or markets. Therefore, carefully consider whether such trading is suitable for you considering your financial condition.

With Cyber-attacks on the rise, attacking firms in the healthcare, financial, energy and other state and global sectors, Blue Line Futures wants you to be safe! Blue Line Futures will never contact you via a third party application. Blue Line Futures employees use only firm authorized email addresses and phone numbers. If you are contacted by any person and want to confirm identity please reach out to us at info@bluelinefutures.com or call us at 312- 278-0500

Performance Disclaimer

Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program.

One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results.